Feb 6, 2023 - Week 6

Volume 7S-91| Pages 2

Budget 2023-2024 envisions a prosperous and inclusive India

Bharat First Visit IndiaWiki.org

Feb 10, Adani Enterprise

(AE) shares still hovered

at a 46% discount to the

price they were quoted

at on Jan 25th, the day

short-seller Hindenberg

Research came out with

its controversial report

alleging market

manipulation by the

conglomerate. However

they have risen 19%

higher from the lowest

point on Feb 3.

Despite the listed price

of AE falling lower than

that demanded in the

FPO, the offer was fully

subscribed after local

tycoons chipped in. On

Feb 1, however Gautam

Adani cancelled the FPO

claiming it to be the

moral thing to do. Less

than a week later, in a

bid to restore investor

confidence he also

prepaid loans worth

$ 1.1 billion in three

group companies Adani

Green Energy, Adani

Ports, and Adani

Transmission. The group

intends to prepay all

share-backed financing it

has assured investors.

At: NationalNews, TelegraphIndia

Massive quake in

Turkey, Syria,

over 28,000 dead

Feb 12, More than

28,000 people have

been killed and tens of

thousands injured after

a magnitude 7.8

earthquake struck

Turkey and Syria on

Monday.

Rescue operations are

over in rebel-held areas

of northwest Syria.

Relief efforts there have

been complicated by a

long-running civil war.

The Syrian government

approved sending aid to

the rebel-held

territories Friday but did

not provide specifics.

Workers in Turkey are

still trying to pull

survivors from the

rubble and there have

been some harrowing

stories of success. But

some organizations

paused rescue work due

to security concerns

Saturday. At least 98

people were arrested

on Saturday by Turkish

security forces over the

alleged looting of

damaged buildings.

At: CNN

Feb 9, Pakistan's

economy is in an

unprecedented crisis as

its forex reserves have

fallen to $2.91, enough

only to cover three

weeks imports. Its rupee

dived to a historic low of

275 to the US dollar and

inflation is looming at

27%. Pakistan stares at

increasing taxes by $ 170

billion to be able to

secure an IMF loan

which will bail it out

from a default on debt.

The availability of IMF

money will avoid the

default but it is feared to

bring a tsunami of price

hikes. At: EconomicTimes

Pakistan faces

economic crisis

Feb 6, 2,278 accused,

including 60 qazis were

arrested till Sunday as

the police acted on

more than 4,000 FIRs

on child marriage cases

in Assam. Arrests are

from districts of central

and lower Assam which

have a large population

of illegal Bangladeshi

Muslims.

On Jan 23, the Assam

government decided to

arrest men who

married girls below the

age of 14 years under

the POCSO Act and

apprehend those who

married girls between

the age group of 14 to

18 under the

prohibition of the child

marriage act.

More than 8,000

accused were named in

the 4,074 cases

registered in such

cases. Action will also

be taken against

parents and qazis who

arranged to perform

such illegal marriages.

Hundreds of marriages

have been cancelled in

the wake of this drive.:

At: OpIndia

Adani withdraws

fully paid FPO;

pre-pays loans

GDP growth remained

robust at 7% in the

current year and is

projected to remain

above 6 % in 2023-2024

as well. India’s GDP

growth in the current

year was the highest

amongst all major

economies of the world.

The nominal GDP for

2023-2024 has been

projected at ₹ 302 lac-

crores.

The Minister announced

that since 2014 India’s

per capita income has

more than doubled to

₹ 1.97 lac. In these nine

years, the Indian

economy has risen from

being 10th to 5th largest

in the world. The

economy has become a

lot more organized as

reflected in the EPFO

membership which

more than doubled to 27

crore and a massive

volume of 7,400 crore

digital payments worth

Feb 1, Feb 1, Union

Finance Minister Nirmala

Sitharaman presented

the Budget for 2023-

2024 highlighting how

India will remain a strong

performer amid

continuing global geo-

political and economic

uncertainties. The

budget envisioned a

prosperous and inclusive

India.

Shaligram shilas sent from Nepal for

murtis in Ayodhya’s Shri Ram temple

J&K: 2.6 lac-acres

illegally occupied

being retrieved

Assam: 2,278

arrested for child

marriage

PM Jan Dhan bank

accounts, Insurance

cover for 44.6 crore

persons under the PM

Suraksha Bima and PM

Jeevan Jyoti Yojana

schemes and Cash

transfers of ₹ 2.2 lac-

crore to over 11.4 crore

farmers under PM Kisan

Samman Nidhi.

Feb 10, a huge reserve

of non ferrous metal-

Lithium has been

located in the Salal –

Haimana area of the

Reasi district of Jammu

and Kashmir. The

Geological Survey of

India (GSI) has

discovered the

country’s first deposit

of about 5.9 million

tonnes of inferred

resources (G3) of

Lithium.

It is stated to be second

largest Lithium reserve

in the world. Sources

said that the deposits

are worth ₹ 38 lac-

crores.

This discovery will help

in India’s transition to

EV vehicles smoother

as Lithium is a major

component for making

EV batteries

Lithium is also used to

make rechargeable

batteries for mobile

phones, laptops, digital

cameras etc and for

non-rechargeable

batteries for things like

heart pacemakers, toys

and clocks. A

Magnesium-Lithium

alloy is used for armour

plating. Aluminium-

Lithium alloys are used

in aircraft, bicycle

frames and high-speed

trains.

Chile has the largest

Lithium reserves in the

world of nearly 9.8

million tonnes. India is

now, next with larger

reserves than Australia,

Argentina or China.

At: TravelTourismTimes,

InvestingNews Image: ANI

World’s second largest Lithium

deposits located in Jammu & Kashmir

₹ 126 lac-crore being

through UPI in 2022.

An impressive set of

accomplishments in

social development over

this period includes the

construction of 11.7

crore household toilets

under Swachh Bharat

Mission, 9.6 crore LPG

connections under

Ujjawala, 220 crore

Covid vaccination of 102

crore persons, 47.8 crore

₹ lac-crores

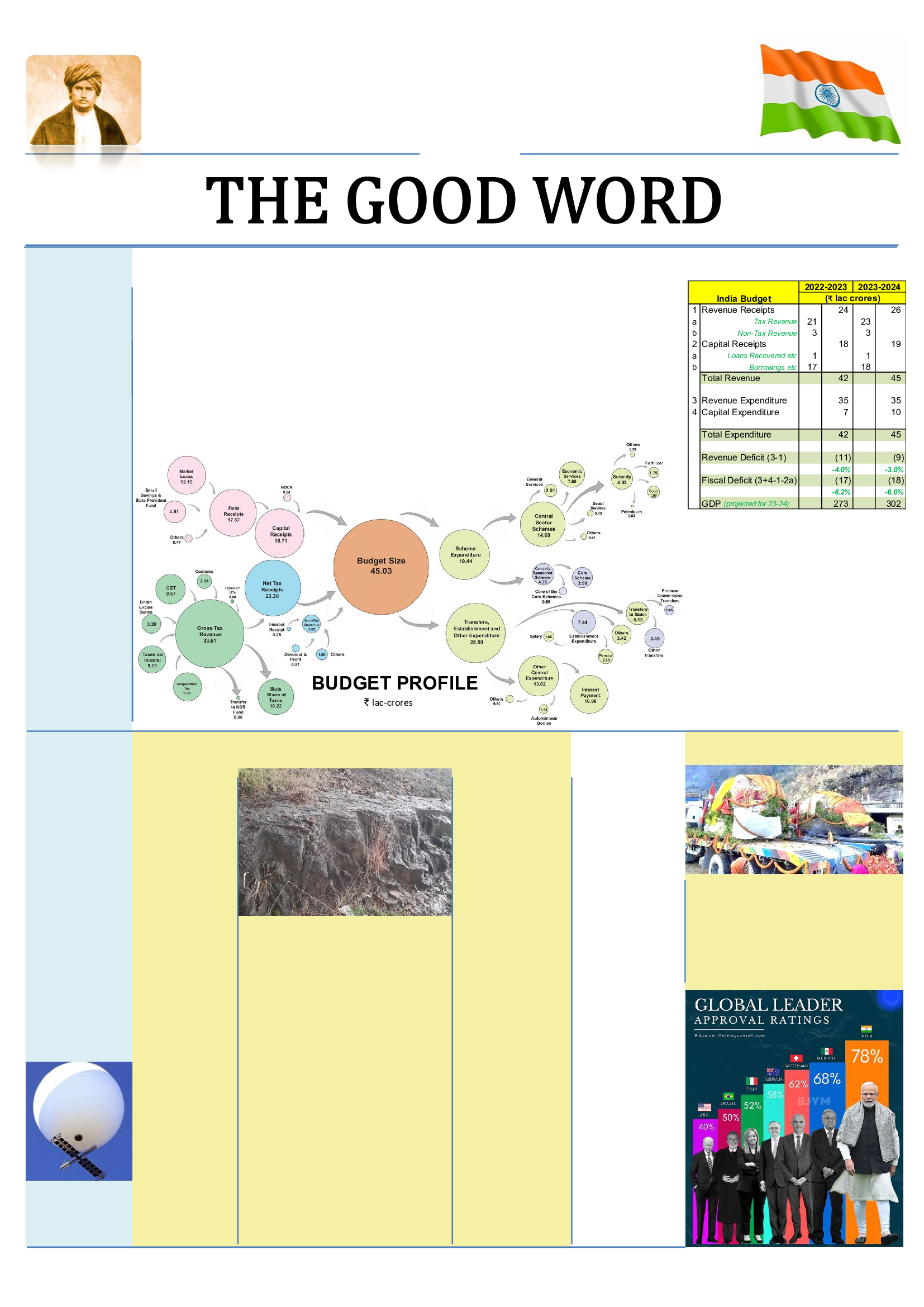

1 Revenue Receipts 24 26

a

Tax Revenue

21 23

b

Non-Tax Revenue

3 3

2 Capital Receipts 18 19

a

Loans Recovered etc

1 1

b

Borrowings etc

17 18

Total Revenue 42 45

3 Revenue Expenditure 35 35

4 Capital Expenditure 7 10

Total Expenditure 42 45

Revenue Deficit (3-1) (11) (9)

-4.0% -3.0%

Fiscal Deficit (3+4-1-2a) (17) (18)

-6.2% -6.0%

GDP

(projected for 23-24)

273 302

2022-2023 2023-2024

(₹ lac crores)

India Budget

BUDGET PROFILE

Revenues:

The bulk of the revenue

receipts, nearly 89%, are

from taxes and these

saw impressive growth in

the current year. Tax

revenues have been

pegged at 11% of the

GDP for 2023-2024. 6%

of these will accrue as

direct tax and the rest as

indirect tax.

The budget projects that

83% of the government’s

tax revenues will accrue

from its three main taxes

GST, Corporate and

Income Tax. The

magnitude of the tax

inflows will be nearly

equal, between ₹ 9 to

9.5 lac-crores. The

Centre’s net tax revenue

is expected to rise by

about 12% over the

2022-2023 revenue

estimate.

The three major taxes,

and even Customs Duty,

are expected to rise

between 11 and 12%

above the 2022-2023

revenue estimates.

Pg 2

US shoots down

China spy-balloon

Swami DayanandaSaraswati birth anniversary, Feb 12 – image courtesy Wikipedia

Feb 3, two sacred

Shaligram shilas

(boulders) excavated

from the Kali Gandaki

River in Janakpur, Nepal

were sent to Ayodhya to

build the murtis of Sri

Ram and Maa Janaki at

the upcoming Ram

Janmabhoomi temple in

Ayodhya.

Janakpur is the

birthplace of Maa Sita

and Shaligram stones

are considered to be an

incarnation of Bhagwan

Vishnu.

At: HinduPost Image: Twitter

ED attaches P

Chidambaram’s

wife’s assets

Feb 3, The Enforcement

Directorate (ED) has

attached assets worth ₹

6.30 crore belonging to

Nalini Chidambaram, wife

of former Union minister

and Congress leader P

Chidambaram, and others,

in its ongoing investigation

into the Saradha chit fund

scam under the Prevention

of Money Laundering Act

(PMLA).

At: IndianExpress

Feb 4, the US used an F-

22 jet to fire a

Sidewinder missile and

down the Chinese spy

balloon. At: CNBC, 2OceansVibe

Feb 12, over the past three

weeks, hundreds of kanals

of government land have

been retrieved and

buildings bulldozed in the

eviction drive. Court

documents show a total of

20 lac-kanals or 2.6 lac-

acres of state land is under

illegal occupation. J&K

Lieutenant Governor

Manoj Sinha has assured

the common man ‘won’t

be touched’. Only the

influential, who have

grabbed government

property will be affected. It

is the high and mighty who

have borne the brunt of

the drive. At: HindustanTimes

Feb 6, 2023 | Week 6 | Volume 7S-91

Bharat First Visit IndiaWiki.org

PAGE 2 THE GOOD WORD

Almost three fourth the

Centre’s expenditure is

allocated to eight

heads. Interest

payments budgeted at

₹ 10.8 lac-crores,

Transport ₹ 5.1 lac-

crores and Defence ₹

4.3 lac-crores are the

top three. They are

followed by Subsidies

(for food, fertilizer,

fuel), transfer to States,

Rural Development,

Pensions and Tax

Administration.

The remaining heads of

expense account for up

to 4% of the total

expenditure and

include Education,

Health, Energy,

Agriculture, Telecom &

IT, Urban Development

etc.

Major Expenditure

Heads:

Interest Payments will

shoot up 15% over the

last years by almost

₹ 1.4 lac-crores.

Transport has received

a major thrust. Not

only did the actual

expense in the last

year rise by 11% over

budget but the

projection has been

pegged up by a further

32% for 2023-2024.

Transport has received

an additional outlay of

₹ 1.3 lac-crores over

the last year’s actuals.

The outlay for railways

is a significant part of

this.

Actual Defence spend

rose 6% over the

budget last year and an

additional 6% rise is

provided in the current

year’s budget, taking it

to ₹ 4.3 lac-crores.

This forms about 10%

of the total budget

outlay.

Subsidies: During the

Covid-19 pandemic, to

ensure that no one

goes to bed hungry,

the government had

launched an initiative

to supply free food

grains to over 80 crore

citizens for 28 months.

From Jan 2023, a

scheme to supply free

food grain to all

Antyodaya and priority

households for the

next one year will be

initiated under PM

Garib Kalyan Anna

Yojana and the Centre

will bear the ₹ 2 lac-

crores expenditure on

it.

While there was a 39%

increase in the actual

expenditure on Food

Subsidy over what was

planned this year, the

projected expenditure

is expected to go down

by ₹ 0.9 lac-crores to

₹ 1.97 lac-crores next

year. Similarly actual

Fertilizer Subsidy went

up by 114% of the

2022-2023 budget and

is slated to decrease

steeply next fiscal by

₹ 0.5 lac-crores to ₹ 1.8

lac-crores.

Rural Development

expenditure and

Pensions were both

18% higher than

budgeted in the

current year at about

₹ 2.4 lac-crores. Both

have been projected to

dip a little, between 2

and 4%, next year.

Email: IndiaWiki2020@gmail.com Website: http://TheGoodWord.IndiaWiki.Org

Expenses – Revenue vs

Capital

The government aims to

boost economic growth

by investing in

infrastructure. So the

capital expenditure

outlay for 2023-2024

has shot up by 37% to

₹ 10 lac-crores, over the

last year’s revenue

estimate. Additionally

disbursements of

government grants for

creation of capital

assets are set to rise by

14% to ₹ 3.7 lac-crores.

Expense Categories

The ambitious economic

agenda focuses on two

other key aspects, to

provide opportunities to

citizens and to

strengthen macro-

economic stability.

"Cut this forest down,

and build a city in its

place." "That is done,"

said the ghost,

"anything more?" Now

the man began to be

frightened and thought

he could give him

nothing more to do; he

did everything in a trice.

The ghost said, "Give

me something to do or I

will eat you up." The

poor man could find no

further occupation for

him, and was

frightened. So he ran

and ran and at last

reached the sage, and

said, "Oh, sir, protect

my life!" The sage asked

him what the matter

was, and the man

replied, "I have nothing

to give the ghost to do.

Everything I tell him to

do he does in a

moment, and he

threatens to eat me up

if I do not give him

work." Just then the

ghost arrived, saying,

"I'll eat you up," and he

would have swallowed

the man. The man

began to shake, and

begged the sage to save

his life. The sage said, "I

will find you a way out.

Look at that dog with a

curly tail. Draw your

sword quickly and cut

the tail off and give it to

the ghost to straighten

out." The man cut off

the dog's tail and gave

it to the ghost, saying,

"Straighten that out for

me." The ghost took it

and slowly and carefully

straightened it out, but

as soon as he let it go, it

instantly curled up

again. Once more he

laboriously straightened

it out, only to find it

again curled up as soon

as he attempted to let

go of it. Again he

patiently straightened it

out, but as soon as he

let it go, it curled up

again. So he went on for

days and days, until he

was exhausted and said,

"I was never in such

trouble before in my

life. I am an old veteran

ghost, but never before

was I in such trouble.“

(to continue next week)

-Swami Vivekananda

Karma Yoga

a series of extracts

Swami Vivekananda Image courtesy Newsgram.com;

This is an important

change and could have

a bearing on foreign

inflows into India.

As regards indirect

taxes, the proposals aim

to boost domestic

manufacturing,

promote exports, and

enhance domestic value

addition, encouraging

green energy and

mobility. From a GST

perspective, restrictions

are placed on Input Tax

Credit on activities

pertaining to Corporate

Social Responsibility

obligations as per

Companies Act, 2013.

The monetary threshold

for launching

prosecution for

offences under GST has

also increased from ₹ 1

crore to ₹ 2 crore.

From Pg 1

On the direct tax front,

the Budget continued its

focus on easing

compliance, widening

the tax base and

rationalisation of

provisions. The new tax

regime saw a series of

changes designed to

make it more attractive

for taxpayers, including

through a change in the

slab rates, rebate and

surcharge (image right

bottom). Provisions

benefitting MSMEs and

start-ups were also

introduced. Anti-abuse

provisions that targeted

companies raising

capital at high premiums

were expanded so as to

cover investments by

non-residents.

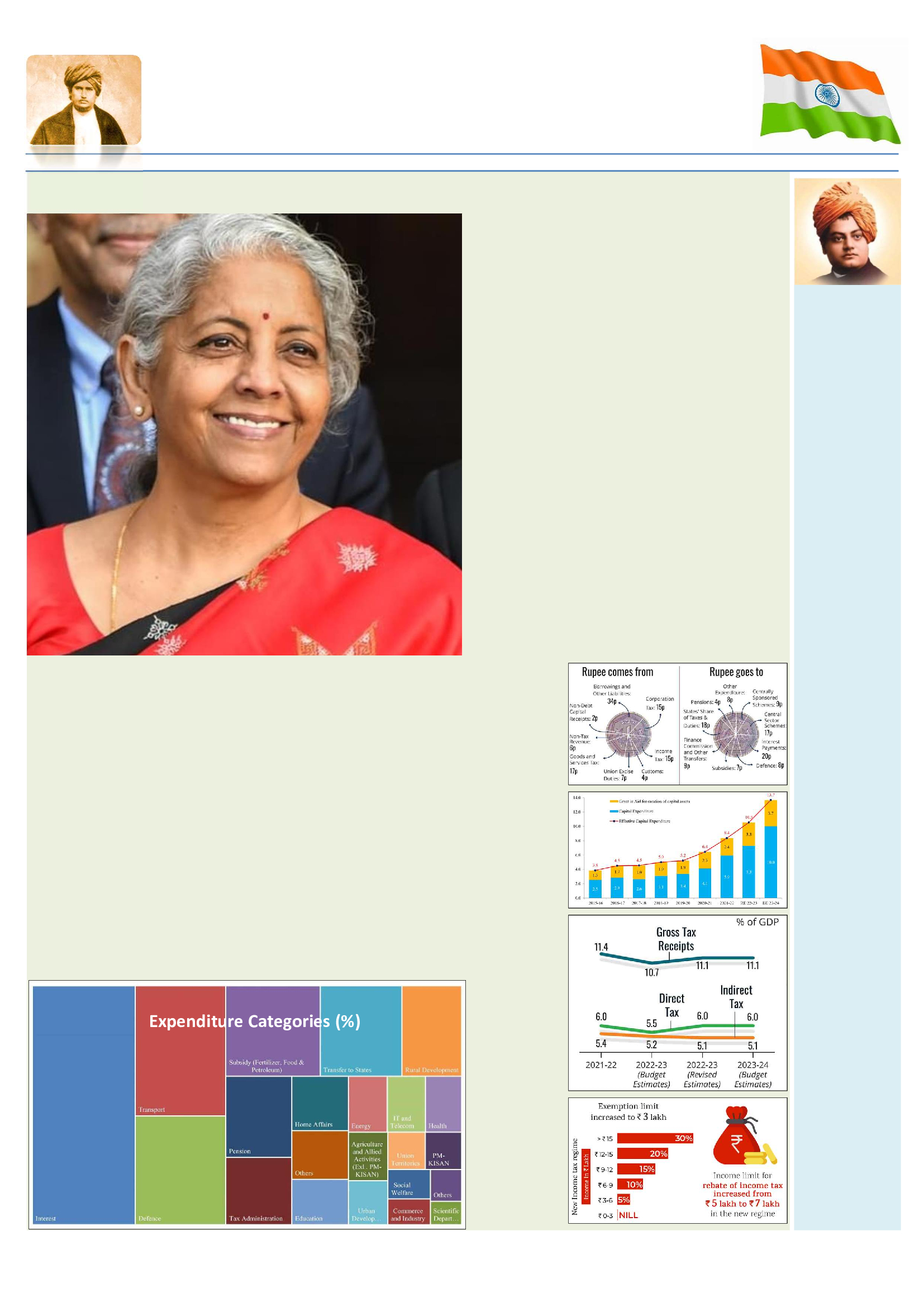

FM Nirmala Sitharaman: On course to meet a 4.5% fiscal deficit by 2025-2026

Expenditure Categories (%)

Other Expenditure

Heads:

Education expenditure

is budgeted to rise 13%

over the actuals of

2022-2023 to ₹ 1.1 lac-

crores.

The actual spend on

Energy in 2022-2023

was almost 44% higher

than budgeted. It is

now slated to go up a

further 34% to ₹ 0.9

lac-crores. The budget

reiterated the

commitment to green

growth and to move

towards a net-zero

carbon emission by

2070.

IT & Telecom, Health

and Agriculture &

Allied Activities saw a

slightly lower actual

expenditure than

planned, the dip being

between 7% and 11%.

They have been

projected to grow in

2023-2024 at 26%, 15%

and 10% respectively.

There is a sustained

push towards building

of digital public

infrastructure in

agriculture, credit to

farmers and the

cooperative sector.

The Finance Minister

lauded India’s

accomplishments in

creating unique world

class digital public

infrastructure with

Aadhaar, Co-Win and

UPI at unparalleled

scale and speed.

A 64% drop over the

2022-2023 budget has

been planned in the

current year with

respect to Finance

expenditure taking it

down to ₹ 0.1 lac-

crores.

Fiscal Deficit:

The revised estimate of

the fiscal deficit for

2022-2023 is 6.4% of

the GDP and adheres

to the budget

estimate. The fiscal

deficit budged for

2023-2024 is 5.9 %. It is

on course to achieve a

target set in two years

ago of lowering the

deficit to below 4.5%

by 2025-26.

At: Gov, MyGov, KPMG, JagranJosh

the